If your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. You will have to submit a form describing your property and sufficient proof that it is overassessed, including valuations of similar homes nearby as evidence. appraised at a value higher than the true market value of the property), you can attempt to get your home re-appraised at a lower value by contacting the Assessor's Office to submit a property tax appeal. If you believe that your house has been unfairly overappraised (i.e.

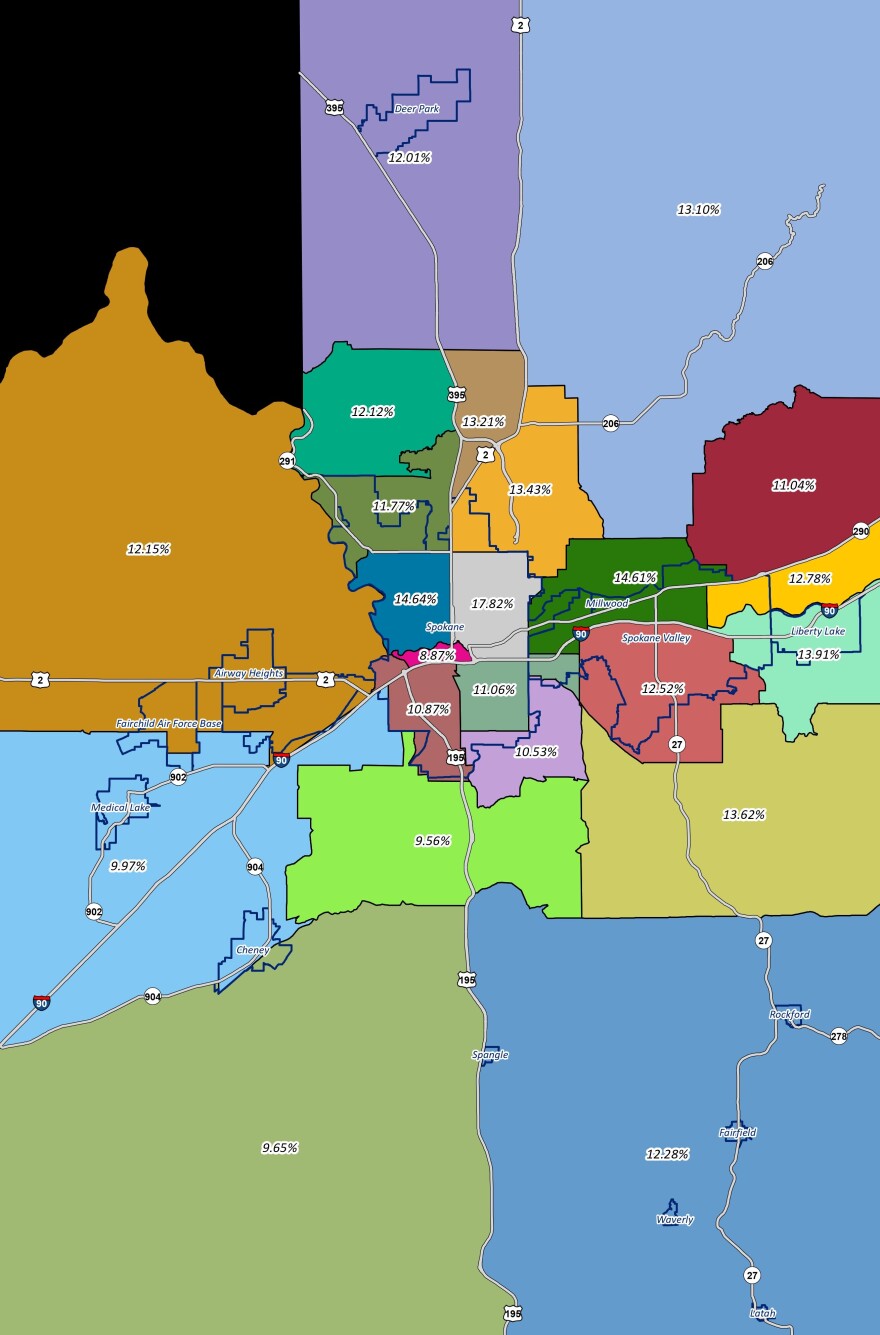

Submitting a Spokane County property tax appeal The Spokane County Tax Assessor's Office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in Spokane County.Ĭontact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or other tax exemption, reporting upgrades to your home, appealing your property tax assessment, or verifying your property records. What can the Spokane County Assessor's Office do for me?

The Spokane County Tax Assessor Office is located in the Spokane County Courthouse building in Spokane, Washington.

0 kommentar(er)

0 kommentar(er)